NFT Flipping in 2025: Strategies, Platforms & Risks for Resellers

NFT flipping in 2025 is gaining traction as a fast, data-driven way to profit from the NFT market. Here’s how it works and what you need to succeed.

NFT flipping in 2025 is booming due to rising interest in low-entry, high-reward trading. More traders are using smart tools and short-term strategies to turn quick profits in volatile markets. So, what is NFT flipping? Imagine you’re at a digital yard sale, and you spot a shiny digital asset—let’s say a pixelated cat wearing a top hat. You purchase an NFT for a price that makes your wallet weep, then you turn around and sell it for a price that makes your wallet sing! That’s flipping in the NFT market—buy low, sell high, and hope the cat doesn’t go out of style.

Now, why is flipping making a comeback in 2025? With the NFT ecosystem booming and new NFT projects popping up like mushrooms after rain, savvy NFT investors are realizing that making quick profits is easier than finding a cat meme on social media. The NFT landscape is full of market trends that keep the excitement alive and attract both newcomers and seasoned traders alike.

Let’s break down the differences: flipping vs collecting vs long-term investing. Flipping is like speed dating—quick, thrilling, and you’re out before you know it. Collecting is a long-term relationship where you cherish your NFTs and hope they appreciate in value. Investing is like planting a tree and waiting years for fruit—sometimes with tears. In 2025, NFT trading strategies have matured, making it easier to find your style in this fast-moving market.

What Is NFT Flipping in 2025?

The classic rule of flipping NFTs is simple: buy low, sell high. But in reality, it’s like trying to catch a greased pig at a county fair—exciting, chaotic, and often messy. With blockchain-based digital assets, timing is everything. A split-second decision can mean the difference between scoring a profit or being left holding a digital potato.

NFT marketplaces are buzzing with transactions, from meme projects to serious collections. The two key factors behind flipping success are liquidity and hype. The more hype a project gets, the faster it moves. Knowing when to enter or exit can turn NFTs into a fast-moving revenue stream.

Every time you buy NFTs, you’re making a bet on value. Will it rise? Will it crash? Understanding the NFT space and how different projects behave under pressure is crucial. Whether you’re after quick flips or long-term trades, it’s essential to use risk management strategies and stay updated on market patterns.

Top NFT Flipping Strategies in 2025

1. Mint and Flip Early

So, you want to get on those coveted whitelists for platforms like Premint.xyz, Zealy, and Galxe? First, dive into the NFT community—join Discord servers, participate in quests, and engage with projects early. It’s not just about hype; early participation gives you a strategic edge to access low-cost mints before they hit public markets.

Next comes the flipping. The trick is to sell during the pre-reveal window—when buyers speculate on rare traits and prices spike. Platforms like Mint.fun, HeyMint, and Tropee make it easier to track new projects and upcoming drops. Successful flippers also diversify their mints—testing multiple projects to spread risk and maximize chances of hitting a profitable one.

But beware of instant dumps and bad reveals. Not every mint leads to moon. Sometimes that promising pixelated cat turns out to be… a potato in a hat. Using NFT analytics tools before committing—like checking wallet distributions or prior project history—can prevent costly mistakes.

2. Buy Low, Sell High on Marketplaces

This classic strategy revolves around identifying undervalued NFTs and flipping them during market upswings. But how do you spot a digital gem? Use platforms like Icy.tools, NFTGo, and Trait Sniper to track rare attributes, floor price movement, and listing pressure.

Many successful flippers monitor the gap between floor NFTs and rare ones—then buy below-average price points with hidden traits. Others look for sudden volume spikes, rising bids, or reduced listings—all signs of incoming demand. The faster you act, the better your chances of profit.

And remember—timing is everything. Selling too early can cost you gains; holding too long can trap your capital. Use analytics tools daily, watch collection activity, and don’t hesitate to exit when ROI aligns with your goals. NFT flipping isn’t guessing—it’s measured, data-driven trading.

3. Sweep the Floor Strategy

Welcome to the world of floor sweeping—no brooms required! This strategy involves buying the lowest-priced NFTs in a collection (a.k.a. “the floor”) before a potential price surge. The idea is to accumulate multiple cheap NFTs and sell when the collection gains traction or attention.

It works best when supply is low, volume starts rising, or a marketing campaign is about to launch. Blur.io’s interface allows flippers to sweep multiple NFTs at once, increasing exposure and potential upside. But be careful: illiquid floors and fake hype can trap you in a slow dump.

Gas traps, influencer shills, and sudden mint announcements can tank floor prices quickly. Make sure to check how many wallets hold the collection, what percentage is listed, and how active the devs are. Otherwise, your freshly swept floor may collapse beneath you.

Common Flipping Mistakes to Avoid

- FOMO buys: Jumping into projects without research, driven by hype and fear of missing out.

- Ignoring liquidity: Buying NFTs from collections with low volume or few buyers.

- Overpaying for rarity: Assuming rare traits always translate to demand.

- Misjudging timing: Selling too early or holding too long.

- Forgetting about fees: Losing profits due to platform and royalty cuts.

The key? Flip with logic, not emotion. Track real-time data, set profit targets, and avoid hype cycles unless you’re ready to exit fast.

Real Examples from 2024–2025

💥 Failures

- Azuki Elementals: Overhyped mint with poor art reveal and a sharp floor price crash.

- Ethereum Eggs: Meme-based project that pumped and dumped, then vanished.

🚀 Successes

- Pudgy Penguins: Long-term rise due to branding, physical toys, and viral marketing.

- Mad Lads (Solana): High whitelist demand, consistent volume, strong floor growth.

- Blast Early Drops: Low-entry NFTs that generated yield and secondary demand via ecosystem incentives.

Every collection teaches a lesson. From rug pulls to 10x flips, your best asset is observation. Study what worked—and what didn’t.

Is NFT Flipping in 2025 Worth It?

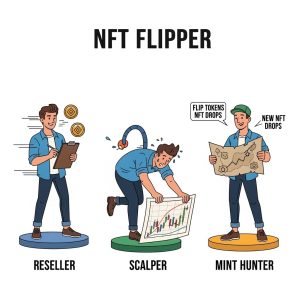

In the wild world of NFT flipping, not everyone’s cut out for the ride. So, who thrives in this space? Resellers flip quickly and consistently, scalpers jump in and out for fast profits, and mint hunters chase new drops like digital treasure.

To succeed in 2025, you’ll need more than enthusiasm. You need timing, research, and nerves of steel. It’s a fast-paced game, and while the rewards can be big, so can the risks. The NFT space rewards attention to detail, flexibility, and the ability to exit before the hype fades.

Is it sustainable? Yes—for those who treat it like a system, not a gamble. Use data, set exit points, and don’t hold bags hoping for miracles. NFT flipping is evolving, and your strategy must evolve too.

Essential Tools for Smart Flipping

Modern flippers rely on analytics. Icy.tools tracks trending NFTs and floor changes. NFTNerds monitors live listings and activity. Flips.Finance estimates profit margins. For rare trait sniping, Trait Sniper and Blur charts help find the sweet spots. Smart flipping is data-driven flipping.

Quick FAQ

How much do I need to start flipping NFTs?

You can start with $50–100 on low-fee platforms like zkSync or Solana. Focus on smaller collections with volume.

Is NFT flipping still profitable?

Yes, but only if you have discipline. Treat it like a trading business—not a lottery.

Are NFT profits taxed?

Yes. In most countries, NFT flips are considered capital gains or income. Track your trades and stay compliant.

Conclusion

Flipping NFTs in 2025 is part hustle, part data science. From mint hunting to marketplace flipping, the game is faster—and smarter—than ever. Whether you’re chasing quick flips or mastering long-term flipping strategies, tools and timing are your greatest allies.

Keep learning, keep flipping—and don’t forget to take profits when you can. The next opportunity is always one click away.

🚀 Want more NFT flipping tools and alpha alerts?

Click here to view our hand-picked NFT trading platforms

Explore more guides on NFT-Fi, NFT minting strategies, and careers in Web3.

🚀 Connect With Us

📬 Stay Updated on Web3 Careers

Join our newsletter to get weekly tips, job openings, and tools for Web3 professionals.

💸 Start Earning with CryptoNav

Explore top crypto platforms, claim welcome bonuses, and support our work through affiliate links: