Crypto: Best Way to Earn Passive Income with Cryptocurrency

Crypto: Best Way to Earn Passive Income with Cryptocurrency

Introduction

Crypto passive income in 2025 is easier than ever to access — without trading or high risk. Many people believe that earning from crypto always means trading charts or chasing market pumps. But in 2025, there are far more stable and beginner-friendly methods. You can now generate steady income from crypto — without trading at all.

This guide will explore how regular users around the world are earning passively through blockchain systems, staking platforms, and digital asset economies — no advanced technical skills required.

1. Staking and Yield Rewards

Staking lets users lock their crypto tokens to support blockchain networks and receive consistent rewards. It’s one of the easiest entry points for passive income in decentralized ecosystems.

Popular Staking Platforms

If you’re exploring ways to earn passive income with crypto, consider top-tier platforms like

Binance Earn,

Lido, and

Bybit Flexible Staking.

These services offer flexible or locked staking options for both beginners and experienced holders.

How to Stake ETH

🚀 Start Earning in 5 Minutes: Staking ETH

- Buy ETH on an exchange like Binance.

- Connect Wallet via WalletConnect or MetaMask to Lido.

- Stake ETH → Receive stETH (approx. 4.3% APY).

- Optional: Restake stETH on EigenLayer for additional rewards (+2%).

Estimated Total Yield: Up to 6.3% APY (as of May 2025).

With just a few clicks, you can start earning interest on your digital assets like ETH, SOL, or stablecoins. The concept is simple: you lock your tokens, the network becomes more secure, and you get rewarded.

For those who prefer lending, crypto lending platforms also offer reliable returns without the need to trade. You can lend Bitcoin, Ethereum, or stablecoins — and generate income while you sleep.

What to Consider

- Lock Periods & Reward Rates: Longer lock periods usually yield higher APYs. Be sure to read each platform’s terms.

- Network Fees: Ethereum gas fees or Solana network costs can affect your net yield. Always calculate your real return.

- Token Volatility: Crypto assets like DOT or ADA can fluctuate significantly. Choose assets that align with your risk profile.

Understanding these variables is key to building a sustainable crypto income strategy. Tools like

StakingRewards help compare options and optimize decisions.

2. NFT Royalties and Digital Asset Revenue

Non-fungible tokens (NFTs) aren’t just about flipping JPEGs. In 2025, many creators and collectors are earning ongoing royalties through smart contracts. Every time an NFT is resold, a percentage goes back to the original creator — often automatically.

Real Use Cases

- Art Royalties: Platforms like OpenSea and Foundation allow artists to earn 2.5–10% of every resale. For example, the Bored Ape Yacht Club has generated millions in creator royalties over time.

- Music NFTs: Services like Sound.xyz and Royal allow musicians to earn streaming-based revenue from fans holding their NFT drops. Listeners become stakeholders.

- Virtual Real Estate Rentals: In platforms like Decentraland or The Sandbox, landowners rent out digital plots, generating yields of 5–20% annually.

By leveraging NFT royalty contracts and blockchain marketplaces, creators can monetize their work repeatedly — building long-term value in the digital economy.

3. Revenue from DAO Participation

Decentralized Autonomous Organizations (DAOs) are internet-native communities that operate like co-ops. Members with governance tokens can vote, contribute, and often receive revenue-sharing rewards based on performance or contributions.

Examples of Income-Generating DAOs

- Investment DAOs: These groups pool capital to back early-stage crypto projects or buy NFTs. Profits are shared proportionally. The LAO and MetaCartel are leading examples.

- Service DAOs: Organizations like Raid Guild or Colony pay contributors in crypto for marketing, design, or development tasks.

- Creator DAOs: Communities like Mirror and Seed Club distribute tokens to writers, artists, and curators who help grow the ecosystem.

Most DAOs pay through their native tokens or stablecoins, with returns ranging from 2–10% APY depending on treasury models and activity levels. While not a guaranteed income, it’s a growing source of value for engaged users and builders.

⚠️ Key Risks in 2025 You Shouldn’t Ignore

- Staking: On networks like Solana, validators face up to 5% slashing for downtime or poor performance (Solana Foundation).

- NFT Royalties: Platforms like Blur stopped enforcing creator royalties in early 2025, causing collections like Azuki to lose over 60% of secondary revenue.

- DAO Regulation: Ongoing scrutiny from regulators (e.g., SEC vs. Uniswap in 2024) may reduce or freeze DAO earnings in some regions.

Conclusion: Building Long-Term Crypto Income

Earning with cryptocurrency is no longer limited to trading and speculation. Whether you’re staking tokens, collecting NFT royalties, or participating in DAOs, passive income tools are more accessible than ever before.

With the rise of DeFi platforms, users can lend crypto to earn interest or provide liquidity in return for transaction fees. Yield farming and liquidity mining have become powerful strategies for maximizing returns.

Blockchain-based communities reward members for contributions — from development to governance. Even NFTs have evolved from collectibles to revenue-generating assets, with royalties rewarding artists long after the first sale.

Educational hubs and content platforms also join the movement, offering crypto tokens as rewards for learning or engaging. These gamified systems turn knowledge into value.

The decentralized internet of 2025 offers multiple paths to build income. By exploring and combining different methods, you can design a resilient financial strategy that thrives through any market cycle.

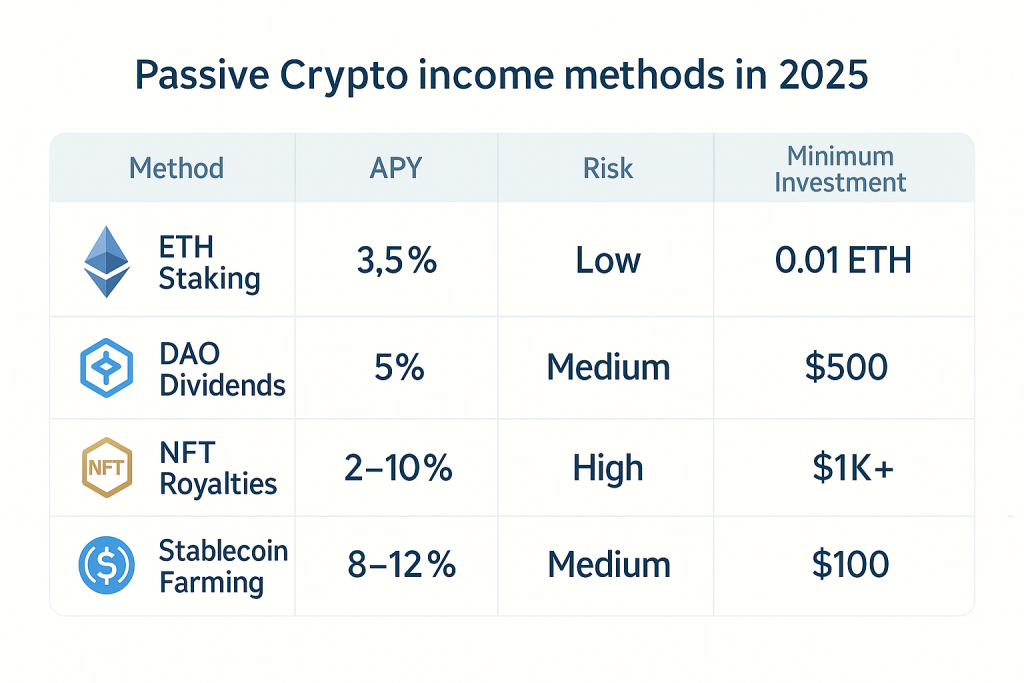

2025 Snapshot: What’s the Best Passive Income Method?

| Method | Top Platforms | Average APY | Min Entry | Main Risk |

|---|---|---|---|---|

| ETH Staking | Lido, Binance, Rocket Pool | 3.1–5.8% | 0.01 ETH | Slashing (up to 1% loss) |

| Stablecoin Yield | Aave, Curve, Ethena | 4.9–11.2% | $100 | Depeg risk (e.g., USDC to $0.98) |

| DAO Dividends | Uniswap, Maker, Aave | 2–8% | $500 | Regulatory (SEC vs Uniswap) |

| NFT Royalties | OpenSea, Blur, Magic Eden | 1–15%* | $1K+ | Demand drop (e.g., BAYC -80%) |

*Based on collection and volume. Data: DeFiLlama, Rekt.news, May 2025.

Case Studies: Passive Crypto Income (2025)

Staking & Yield Rewards

- Lido Finance: Stake ETH to receive stETH and earn ~3–5% APY. Over $20B Total Value Locked (TVL) in 2025 (DeFi Llama).

- Binance Earn: Flexible and locked staking options. Altcoins offer up to 15% APY.

NFT Royalties

- BAYC (Bored Ape Yacht Club): Creators earn 2.5% from secondary sales. Over $2B lifetime trading volume.

- Decentraland Rentals: Virtual landowners earn 5–20% annual yield (via DappRadar).

DAO Dividends

- Uniswap DAO: UNI holders benefit from protocol revenue sharing. Annualized income ~$500M.

- MakerDAO: MKR holders receive surplus revenue generated by DAI stability fees.

ROI Calculator: What Can $1,000 Earn in 2025?

- ETH Staking (4.5% APY via Lido): $45/year

- Stablecoins (USDC on Ethena, 9% APY): $90/year

- DAO (Uniswap, 5% APY + UNI growth): ~$50 + token appreciation

Conservative investors may prefer staking. Risk-tolerant users may choose DAO governance for upside exposure.

Checklist Before You Invest in 2025

Crypto Passive Income FAQ (2025)

Here are the most common questions about crypto passive income in 2025 — from DAO risks to tax tips and starting with a small budget.

Why do 80% of DAOs fail?

Most lack sustainable monetization. According to DeepDAO, only 20% of DAOs generate recurring income in 2025.

How to avoid staking taxes in the EU?

Use Swiss-based custodial platforms like Taurus that offer tax shielding structures.

Is DeFi still safe?

Use platforms with multi-audits and insurance (e.g., Nexus Mutual). Avoid high-APR protocols without liquidity proof.

Crypto Passive Income 2025: What if I Start with Just $500?

Combine:

– $200 in Lido staking (ETH) → $8.50/year

– $200 in USDC farming (Ethena) → $18/year

– $100 in DAO tokens → $5–10 + potential growth

Building long-term crypto passive income in 2025 is no longer just for traders — now it’s about strategy, timing, and secure platforms.

🚀 Connect With Us

📬 Stay Updated on Web3 Careers

Join our newsletter to get weekly tips, job openings, and tools for Web3 professionals.

💸 Start Earning with CryptoNav

Explore top crypto platforms, claim welcome bonuses, and support our work through affiliate links: